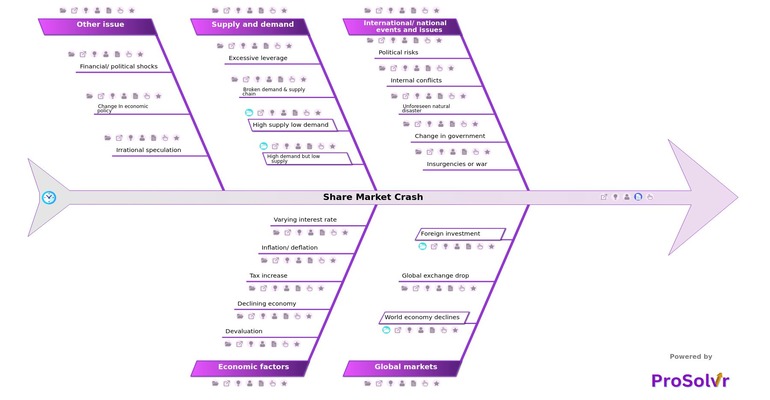

Root Cause Analysis of Share Market Crash

A share market crash is a sudden and dramatic decline in the stock market, characterized by panic selling and significant loss of market value. Utilizing ProSolvr, a cutting-edge root cause analysis tool based on Six Sigma principles, stakeholders can identify root causes and implement corrective actions to address immediate issues. This proactive approach reduces the likelihood of recurrence and ensures better management of future market fluctuations, benefiting the entire economy.

A market crash typically occurs over a short period, such as a few days or weeks, and is marked by a rapid downturn, often catching investors off guard. Panic selling ensues as widespread fear and uncertainty drive investors to sell their holdings, further accelerating the decline. This leads to extreme market volatility, with large swings in stock prices within short time frames, creating a highly unstable market environment.

Using ProSolvr for root cause analysis allows for a thorough examination of the factors leading to a market crash. By identifying these causes, stakeholders can implement measures to stabilize the market and reduce future risks. This systematic approach not only addresses immediate issues but also strengthens the financial system's overall resilience.

Understanding the causes of a share market crash is crucial for investors, policymakers, and financial analysts to mitigate future risks. A fishbone template, also known as an Ishikawa diagram, is a visual tool used in RCA to systematically explore potential causes of a problem. ProSolvr helps organize and categorize the various factors contributing to a share market crash into major categories.

Using ProSolvr by smartQED for more efficient problem analysis and resolution ensures robust corrective and preventive measures, contributing to a more stable and resilient financial market.

Who Can benefit from Share Market Crash template?

Investigating the Share Market Crash is crucial for a broad spectrum of stakeholders, including:

- Individual Investors: Gain insights to make informed portfolio decisions, adopt risk mitigation strategies like diversification, and navigate market volatility more cautiously.

- Large-Scale Investors: Mutual funds, pension funds, and hedge funds can refine investment strategies, improve risk management practices, and adjust asset allocations based on identified vulnerabilities.

- Financial Analysts: Enhance market trend predictions and provide accurate forecasts by incorporating identified factors into analytical models.

- Policymakers: Utilize Gen-AI powered root cause analysis to develop economic policies that promote market stability and address underlying economic issues.

- Financial Regulators: Implement stricter oversight and regulations to prevent identified causes of crashes, enhance market transparency, enforce trading rules, and monitor systemic risks.

- Corporate Risk Managers: Use reliability tools like ProSolvr to develop strategies that mitigate risks associated with market volatility, protecting company assets and reputation.

Why use the Share Market Crash template?

Understanding the causes of a share market crash is crucial for investors, policymakers, and financial analysts to mitigate future risks. A fishbone template, also known as an Ishikawa diagram, is a visual tool used in RCA to systematically explore potential causes of a problem. ProSolvr helps organize and categorize the various factors contributing to a share market crash into major categories.

- Corrective Actions: Immediate actions to address specific issues identified during analysis. For instance, if political instability is a root cause, actions might include policy reforms and dialogue to stabilize the environment.

- Preventive Actions: Actions aimed at preventing recurrence of similar issues. For example, if excessive speculation is identified, implementing stricter regulations on speculative trading and improving market oversight can prevent future crashes.

Draft and create a template for problem analysis in ProSolvr by smartQED.

Curated from community experience and public sources: