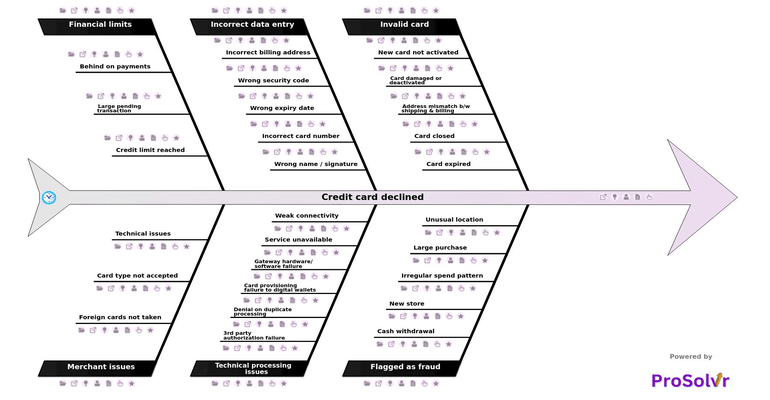

Root Cause Analysis of Credit Card Declined

Credit card declines are a common occurrence in today's digital transactions landscape, often causing frustration for both consumers and merchants alike. Whether you're trying to make a purchase online, at a store, or through a mobile app, encountering a declined credit card can disrupt your plans and lead to inconvenience. Understanding the root causes behind credit card declines is essential for effectively addressing these issues and minimizing their impact on your financial transactions. From technical processing errors to human errors in data entry, a multitude of factors can contribute to a credit card being declined, making it imperative to identify and rectify these issues promptly.

Several common reasons can lead to credit card declines, ranging from simple mistakes to more complex technical issues. Invalid card information, such as an expired card, incorrect billing address, or mismatch between shipping and billing addresses, often results in transaction rejections. Moreover, transactions flagged as fraudulent due to suspicious activities like irregular spending patterns or transactions from unusual locations may trigger fraud alerts and lead to declines. Additionally, technical glitches such as third-party authorization failures or service unavailability can disrupt the payment process and cause transactions to be declined unexpectedly.

Fortunately, there are steps that both consumers and merchants can take to minimize the occurrence of credit card declines. Consumers should ensure that their card information is up-to-date and accurate, double-checking details like the expiration date and billing address before making a purchase. Merchants can implement fraud detection systems and ensure their payment processing infrastructure is robust and reliable to prevent technical issues. Educating customers about common pitfalls and offering alternative payment methods can also help mitigate declines. By understanding the common reasons for credit card declines and implementing preventive measures, both consumers and merchants can enjoy smoother and more seamless transactions, ultimately enhancing the overall shopping experience.

Credit card declines, illustrated in the fishbone diagram, result from factors like incorrect card details, flagged transactions, and technical glitches. To prevent declines, ensure accurate card information, implement fraud detection, and improve payment systems. Understanding and addressing these factors can lead to smoother transactions and better customer satisfaction.

Who should use the Credit Card Declined template?

The Credit Card Declined template is beneficial for anyone involved in financial transactions, including consumers, merchants, and businesses. Consumers can use it to understand why their credit card transactions may have been declined and learn how to prevent such occurrences in the future. Merchants and businesses can utilize the template to educate their staff on common reasons for declines and implement strategies to minimize them, thereby improving customer satisfaction and streamlining their payment processes. Additionally, financial institutions and payment service providers can use the template to educate their clients and users about credit card declines and offer solutions to address them effectively.

Why use this template?

Using the Credit Card Declined template offers a comprehensive approach to understanding and addressing issues related to declined credit card transactions. By outlining common reasons for declines, such as incorrect card details, flagged transactions, and technical glitches, the template equips users with valuable insights into the complexities of payment processing. Armed with this knowledge, consumers, merchants, and businesses can take proactive steps to prevent declines, such as ensuring accurate card information, implementing fraud detection measures, and improving payment systems. Ultimately, leveraging this template facilitates smoother transactions, minimizes disruptions, and enhances overall customer satisfaction, making it an indispensable tool for navigating the intricacies of financial transactions effectively.

Draft and create a template for problem analysis in ProSolvr by smartQED.

Curated from community experience and public sources: